Although limited housing inventory, rising home prices and high mortgage rates have pushed existing-home sales to a 30-year low, a market turnaround is coming in 2025, Lawrence Yun, chief economist for the National Association of REALTORS®, predicted during NAR’s Real Estate Forecast Summit on Monday. He said mortgage rates will likely fall in the coming months, and inventory will likely pick up.

Other economists at the event argued that the housing market isn’t slow per se given pent-up homebuyer demand. “Competition is fierce, not just for home buyers trying to find a home in this limited inventory environment but also for REALTORS® trying diligently to find even a listing to work with a seller or a buyer,” said Jessica Lautz, NAR’s deputy chief economist.

Lautz highlighted some of the opportunities for real estate professionals in the current market, including:

Differentiate Yourself With Facts

Lautz said to counter the misinformation about mortgage rates that is prevalent on social media. During the COVID-19 pandemic, mortgage rates sank to all-time lows in the 2% range, which consumers may have mistaken as normal. Mortgage rates are currently hovering around 7%.

“We have to keep in mind that interest rates right now are just slightly lower than the historical average,” Lautz said. “So, as we talk about interest rates, we have to realize that this interest rate may be good for a first-time home buyer if we look at this historically. Now if we’re thinking of those who have refinanced or purchased a home when interest rates were incredibly low, we know that is a change in a mortgage payment of approximately $800 a month if someone refinanced at 3% for a $400,000 home versus refinanced at 7%.”

Another key misinformation point, Lautz said, is that there’s an emerging “renter generation” and buyer demand has dissolved. However, the average number of offers is about three per listing, higher than the historical norm, Lautz said. “It’s still a strong market,” she added, encouraging real estate pros to discredit misinformation about a housing bubble brewing. Yun shared data showing that distressed home sales—foreclosures and short sales—are at 2%, near historical lows.

“Homeowners are the winners in today’s economy,” Lautz says. “They have a tremendous amount of housing equity that they’re sitting on, with more than $200,000 for the typical homeowner. So, they’re able to make a housing trade, even if there was a shock in that household or if they needed to rent temporarily.”

Low Inventory Hasn’t Cooled Buyer Demand

Where there is inventory, there are greater home sales, Yun said, pointing to an uptick in new-home sales. “Builders are able to create more inventory, and they don’t have to worry about the ‘lock-in effect,’” in which many homeowners don’t want to trade in the low mortgage rate they scored in recent years, he said. Also, the high end of the market, such as listings $750,000 and up, are experiencing greater sales because of more inventory, Yun said. The lack of inventory for listings $250,000 or below is translating to fewer sales, he added.

Yun said he believes the “lock-in effect” likely will subside over time as life circumstances force sellers to action who have delayed a move. Also, the Federal Reserve is largely expected to cut its benchmark interest rate this fall, which could lead to lower mortgage rates in 2025 and prompt more market activity.

Yun further noted the rising U.S. population, which is up 70 million since 1995 (the last time home sales were this low). “There is a large pent-up, stored demand that could be released into the marketplace when conditions improve—lower mortgage rates and more inventory,” he said. And it likely will be soon: “Inventory is finally turning up—up about 15%—and that likely is an early leading indicator that we may finally see more home sales as conditions improve.”

Lautz urged practitioners to continue to talk to their local government officials about the need for more housing inventory to meet population demands, such as exploring conversions of vacant malls or office buildings to residential. She noted that the average age of homes purchased is 38 years old and has risen drastically due to years of underbuilding. “It’s forcing buyers to make compromises,” she said, adding that housing inventory needs to better match the change in buyers. Nearly one-third of buyers are single, the number of households with no children is at an all-time high and buyers are looking for homes where they can age in place or accommodate multigenerational living.

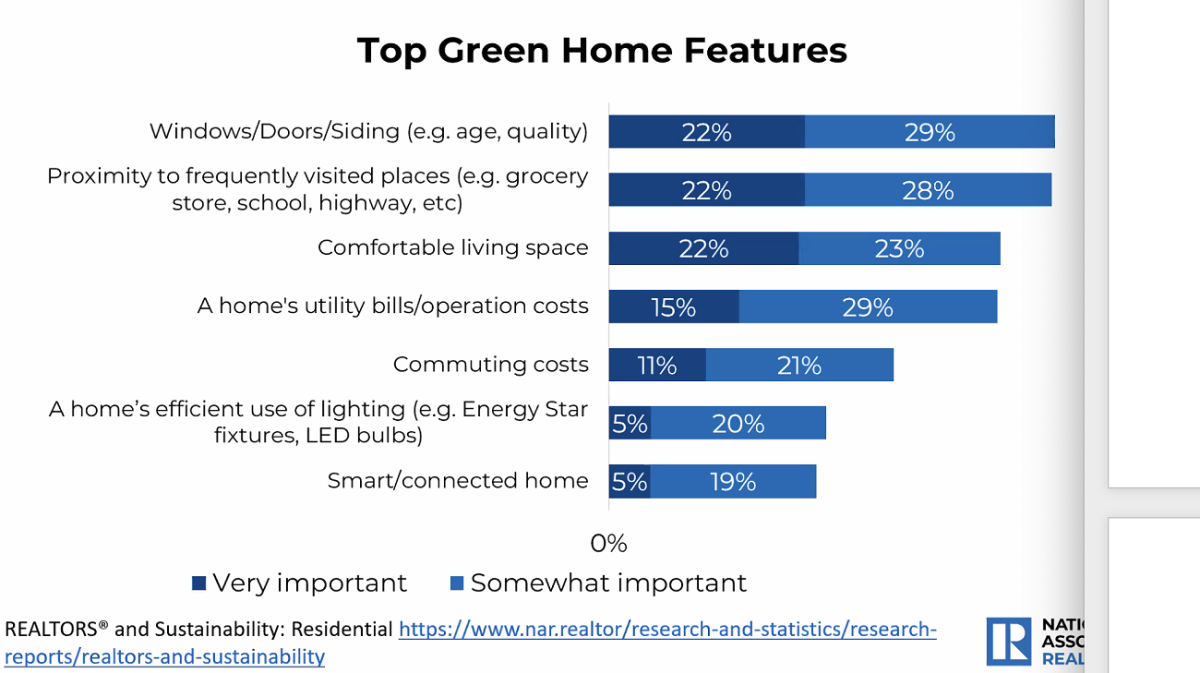

Sustainability a Pillar of Showing Value

The 2024 REALTORS® & Sustainability Report shows that more real estate professionals consider promoting green features to be central to demonstrating their value to consumers. More than a third of agents say they feel comfortable answering questions about sustainability in their listings. The NAR survey showed the importance of the following home features to clients:

First-Time Buyers Return

“We know the hurdles they are facing when thinking about affordability, inventory, student loan debt and high rental costs that have been holding them back,” Lautz said. Yet, first-time buyers are finding a way: They comprised 31% of sales in May, and their market share is steadily inching higher.

“We know there are not as many repeat buyers on the market because they are locked in with their low mortgage rates, so the last few months, we’re seeing higher shares of first-time buyers because they’re competing against fewer repeat buyers,” Lautz said. “With less competition, there is an opportunity for more first-time buyers to enter into homeownership.” Arm them with data about the long-term benefits of homeownership, she said, noting that average homeowner wealth is near $400,000 compared to $10,000 for renters.

Reaching More Diverse Buyers

Homeownership among Asians and Hispanics in the U.S. has hit an all-time high, reaching 63.3% and 51.1%, respectively, according to NAR’s “2024 Snapshot of Race and Home Buying in America.” The report, which reflects 2022 data—the most recent available—shows an uptick in homeownership rates across minority groups. Lautz pointed to opportunities to reach more diverse home buyers and accommodate their housing needs.

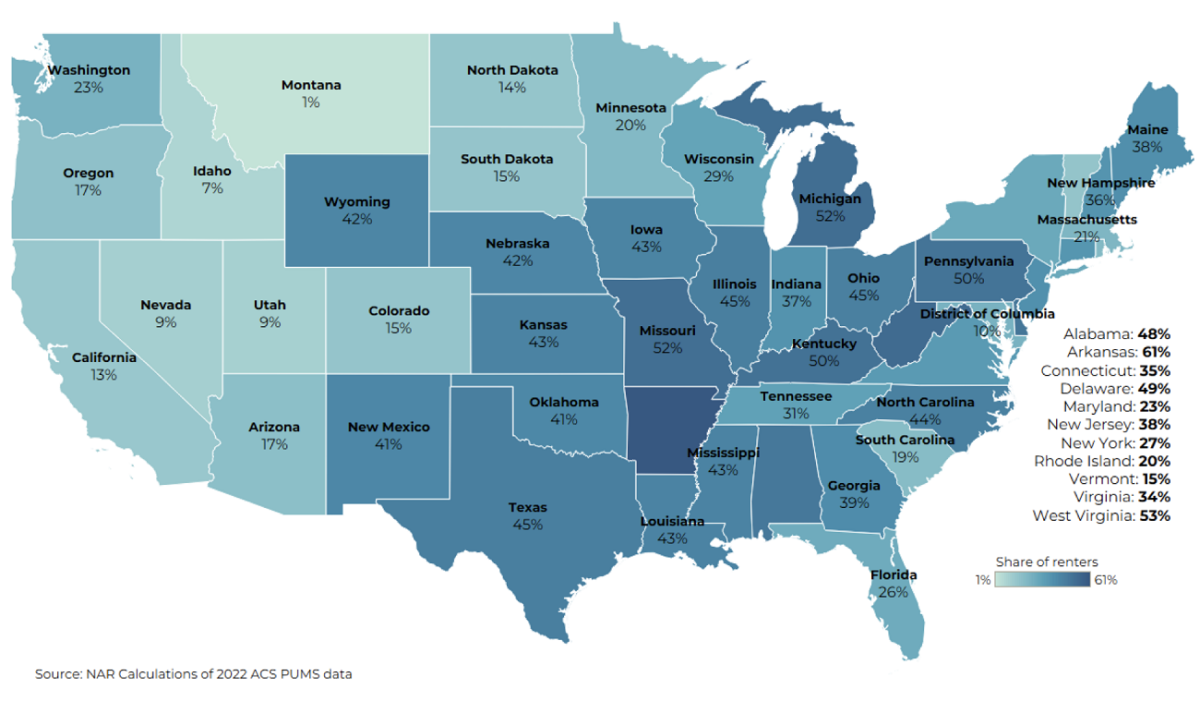

The NAR report offers a state-by-state breakdown of the share of Asian renter households who can afford to buy the typical home:

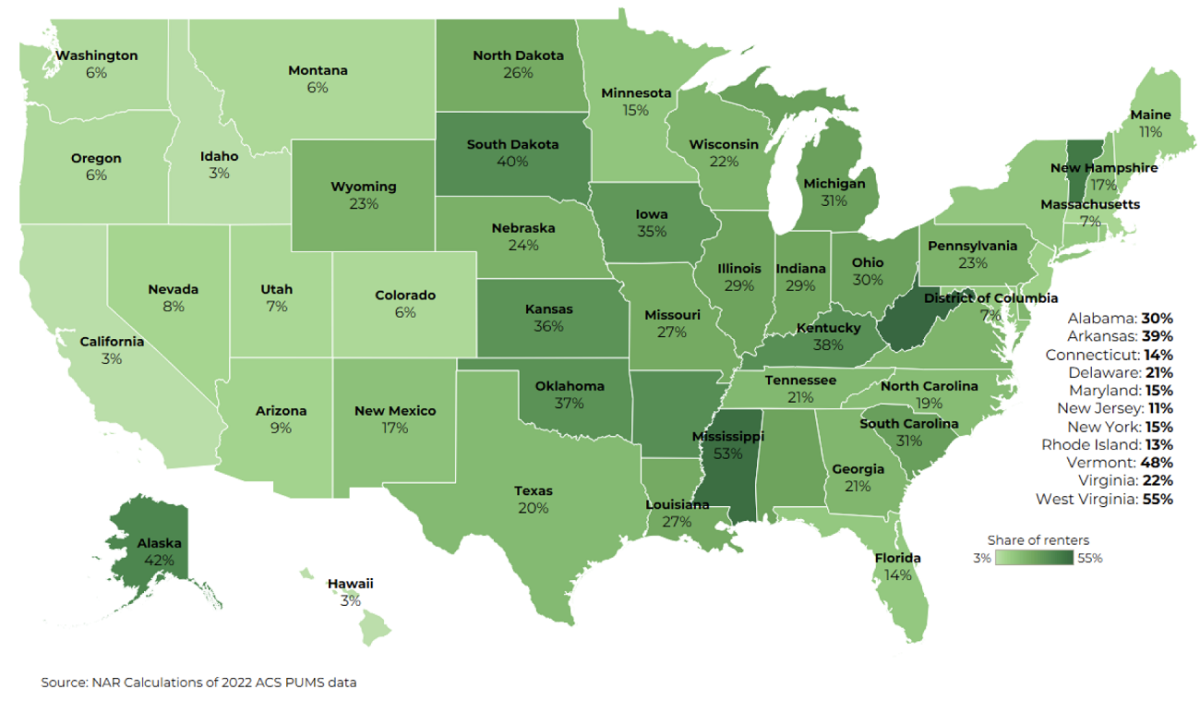

The report also shows a state-by-state breakdown of the share of Hispanic renter households who can currently afford to buy the typical home: